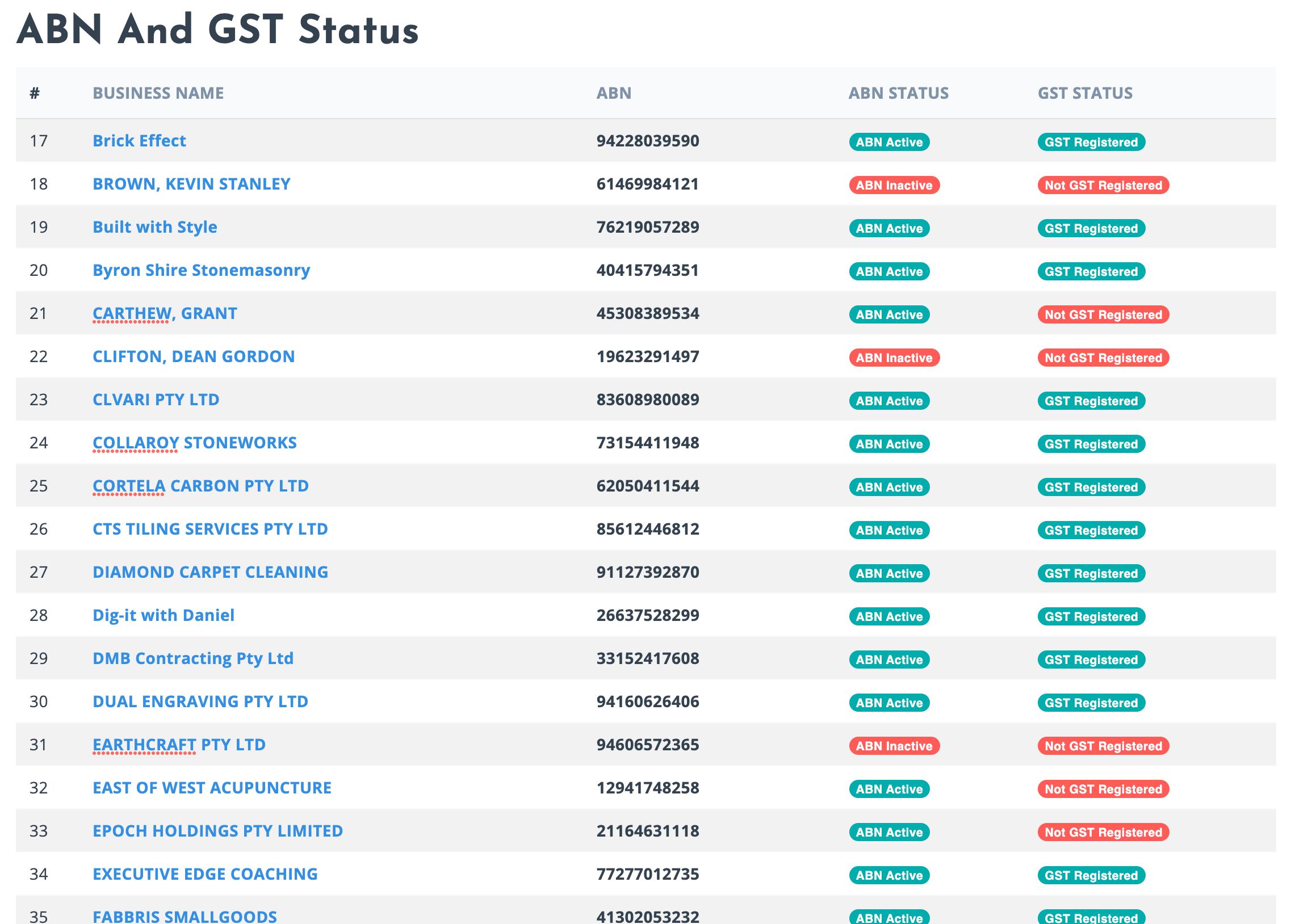

THE EASIEST WAY TO MEET YOUR COMPLIANCE OBLIGATIONS

Whether you're an accounting professional or a business owner, meeting these regulatory obligations has been almost impossible because of the time it takes.

This changes with our FREE ABN and GST Status check tool.